News

October 8, 2025

Your Business Guide to 1099 Filing in 2025: Deadlines and Compliance Tips with Yearli

Businesses must prepare for 2025 IRS 1099 filing by understanding key deadlines for Forms 1099-NEC and 1099-MISC and leveraging e-filing tools like Yearli to stay compliant. This guide outlines important dates, recent IRS updates, and practical tips to avoid penalties and streamline the filing process.

Read More

-

November 5, 2018

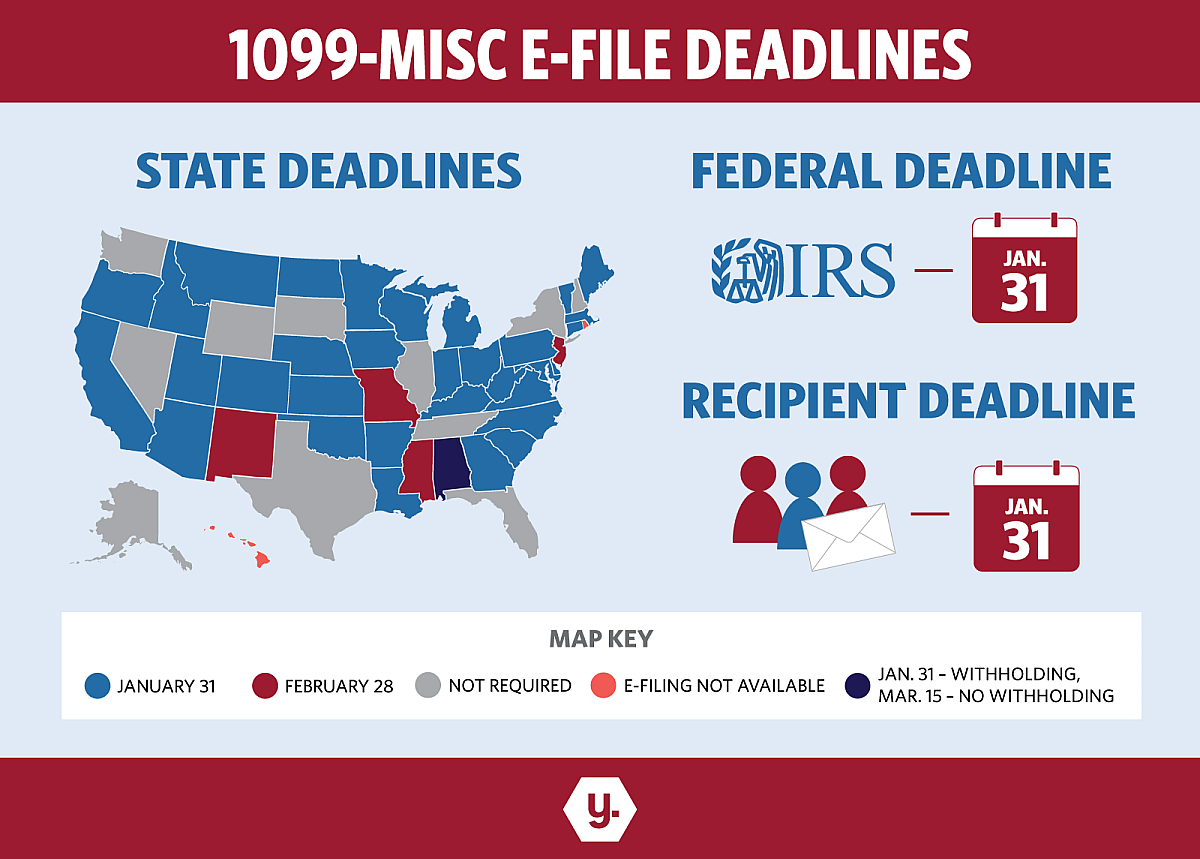

November 5, 20181099-MISC E-File Deadlines

This infographic has everything you need to stay on top of the 1099-MISC federal, state and recipient deadlines for tax year 2018.Read More -

October 26, 2018

October 26, 2018What You Should Know About 2018 W-2, 1099 & 1095 Filing Season

Businesses are gearing up for a busy W-2, 1099 & 1095 filing season in the months ahead, navigating through an accelerated reporting season and getting re-acquainted with specific state and federal requirements.Read More -

October 19, 2018

October 19, 2018What Happens If Your Business Doesn’t Send Employees a W-2 or E-File to SSA?

Each year, experts will tell you to file W-2 forms to your employees and make sure you file correctly and on time. But why is it so important to do these things and do them right?Read More -

October 12, 2018

October 12, 2018Hidden Costs That Affect a Business

Many companies are surprised at the true bottom-line cost of continuing to file W-2 and 1099 forms via paper instead of e-filing to the IRS/SSA.Read More -

September 25, 2018

September 25, 2018Accountants Now Expected to Work Longer Hours

The new reality is that January is expected to be busy for anyone taxed with the responsibility of filing W-2, 1099 or 1095 forms.Read More -

August 31, 2018

August 31, 2018Greatland Corporation Acquires Aabet Business Systems

Greatland Corporation today announced the acquisition of Marin County, Calif.-based Aabet Business Systems.Read More