News

October 8, 2025

Your Business Guide to 1099 Filing in 2025: Deadlines and Compliance Tips with Yearli

Businesses must prepare for 2025 IRS 1099 filing by understanding key deadlines for Forms 1099-NEC and 1099-MISC and leveraging e-filing tools like Yearli to stay compliant. This guide outlines important dates, recent IRS updates, and practical tips to avoid penalties and streamline the filing process.

Read More

-

September 16, 2019

September 16, 20193 Things Your Business Should Know About W-2 Filing

Filing experts will tell you that when your business files W-2 forms, to make sure you file correctly and on time.Read More -

January 8, 2019

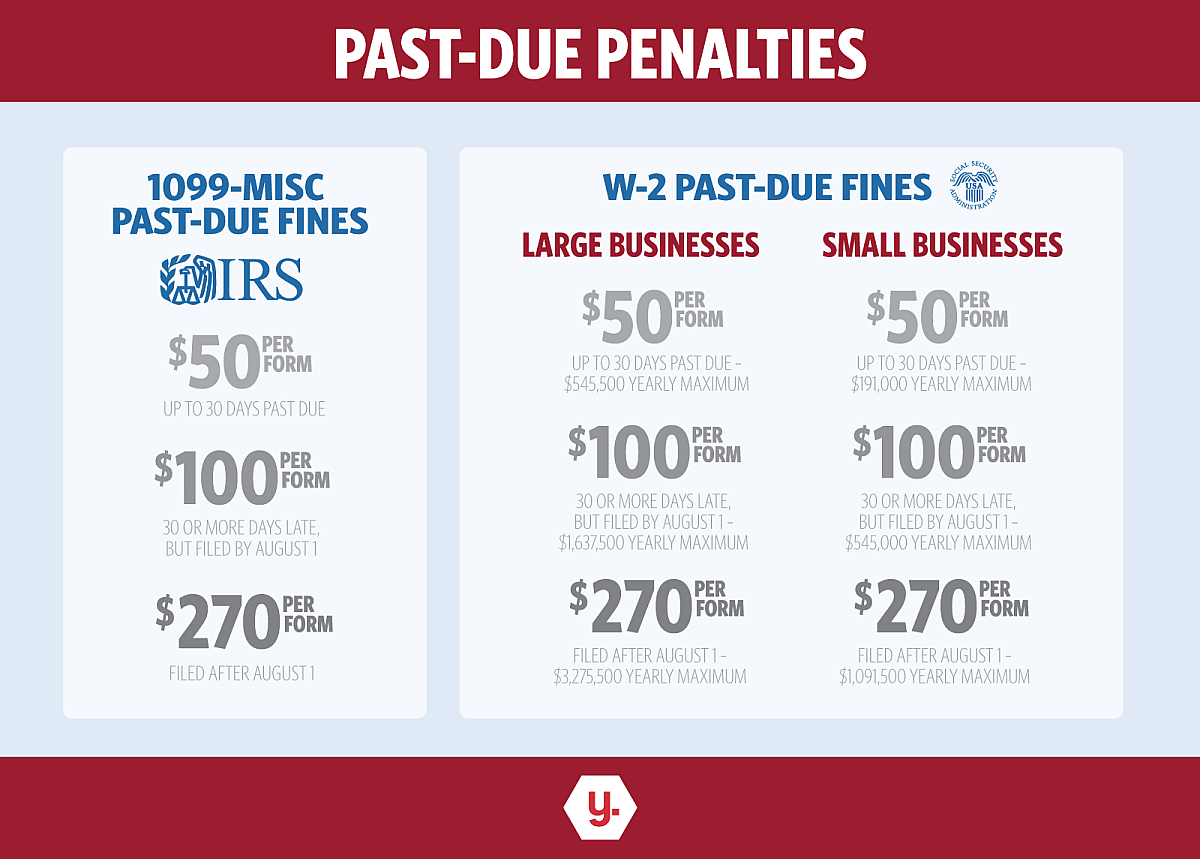

January 8, 20191099-MISC and W-2 Past Due Fines

Don't risk a fine this year for failing to file W-2 & 1099-MISC forms for your business.Read More -

December 21, 2018

December 21, 2018Never Mind Santa, the IRS is Watching… Don’t Let Year-End Filing Mistakes Cost Your Company

Year-end reporting season is usually anything but jolly for business owners and human resources staff charged with wrapping up annual IRS reporting responsibilities.Read More -

December 7, 2018

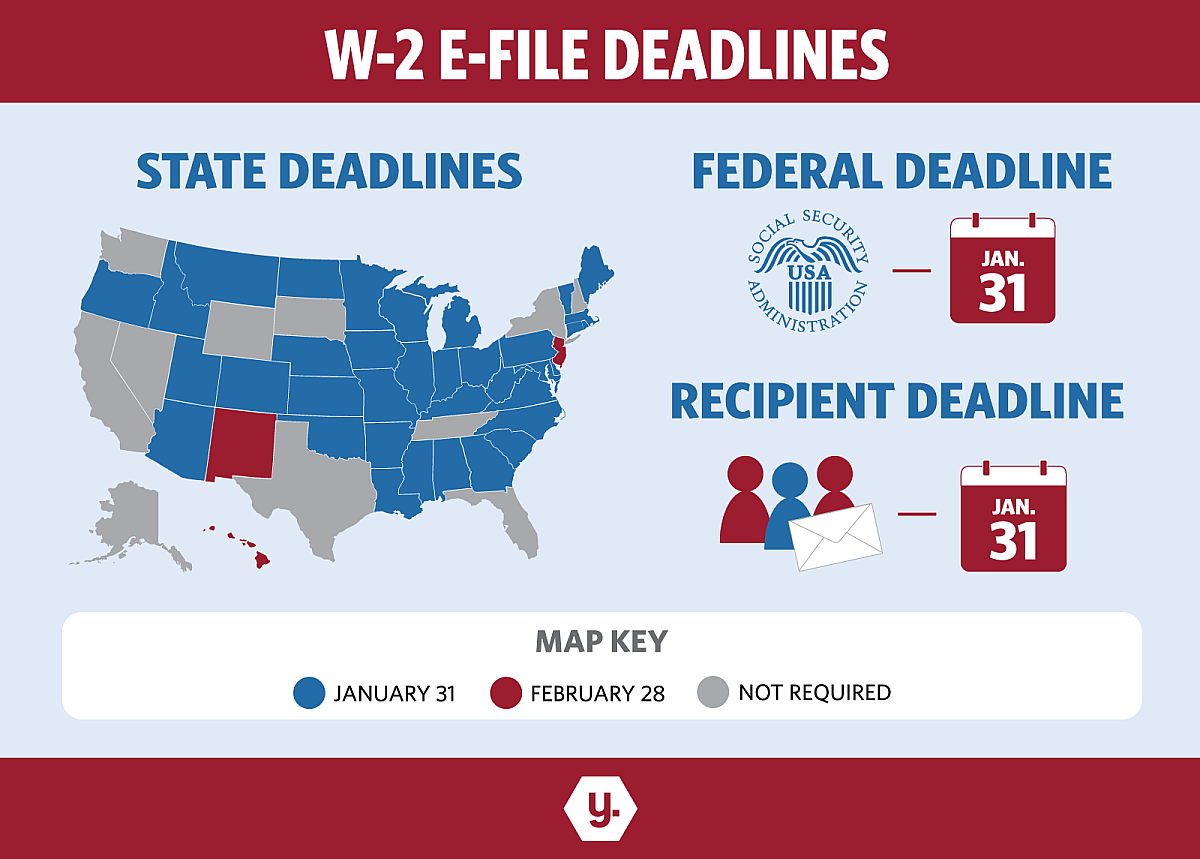

December 7, 2018W-2 E-File Deadlines

This infographic has everything you need to stay on top of the W-2 federal, state and recipient deadlines for tax year 2018.Read More -

November 29, 2018

November 29, 2018IRS Announces ACA Filing Extension for 2018

On November 29, 2018 the Internal Revenue Service (IRS) announced an ACA deadline extension for the 2018 filing season.Read More -

November 14, 2018

November 14, 2018What Happens if Your Business Doesn’t File?

Generally, businesses understand the ins and outs of tax reporting for traditional employees, but what your business might not be aware of is the importance and process of filing taxes for contractors.Read More