News

October 8, 2025

Your Business Guide to 1099 Filing in 2025: Deadlines and Compliance Tips with Yearli

Businesses must prepare for 2025 IRS 1099 filing by understanding key deadlines for Forms 1099-NEC and 1099-MISC and leveraging e-filing tools like Yearli to stay compliant. This guide outlines important dates, recent IRS updates, and practical tips to avoid penalties and streamline the filing process.

Read More

-

December 2, 2019

December 2, 2019IRS Extends ACA Recipient Deadline for 2019

The Internal Revenue Service (IRS) has extended the ACA recipient deadline for the 2019 filing year; also includes furnishing relief to Form 1095-B.Read More -

January 8, 2019

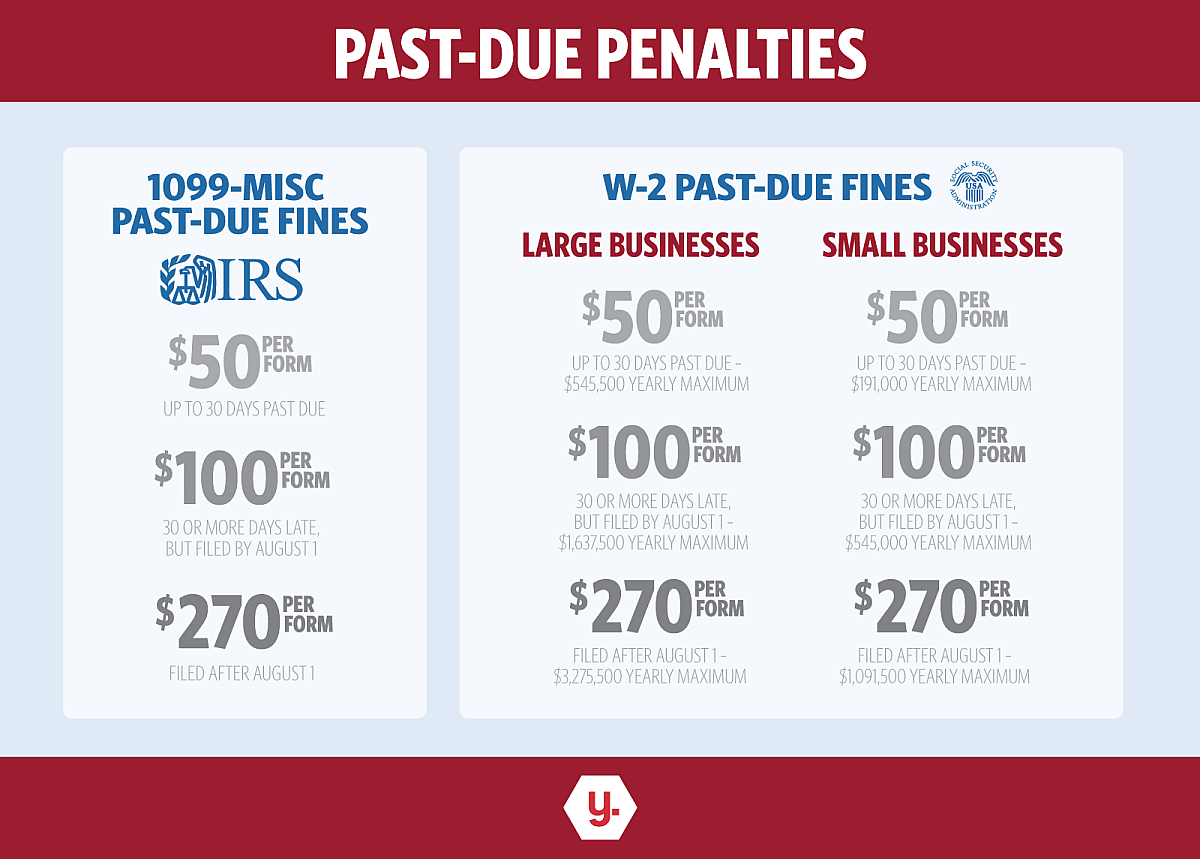

January 8, 20191099-MISC and W-2 Past Due Fines

Don't risk a fine this year for failing to file W-2 & 1099-MISC forms for your business.Read More -

December 21, 2018

December 21, 2018Never Mind Santa, the IRS is Watching… Don’t Let Year-End Filing Mistakes Cost Your Company

Year-end reporting season is usually anything but jolly for business owners and human resources staff charged with wrapping up annual IRS reporting responsibilities.Read More -

December 7, 2018

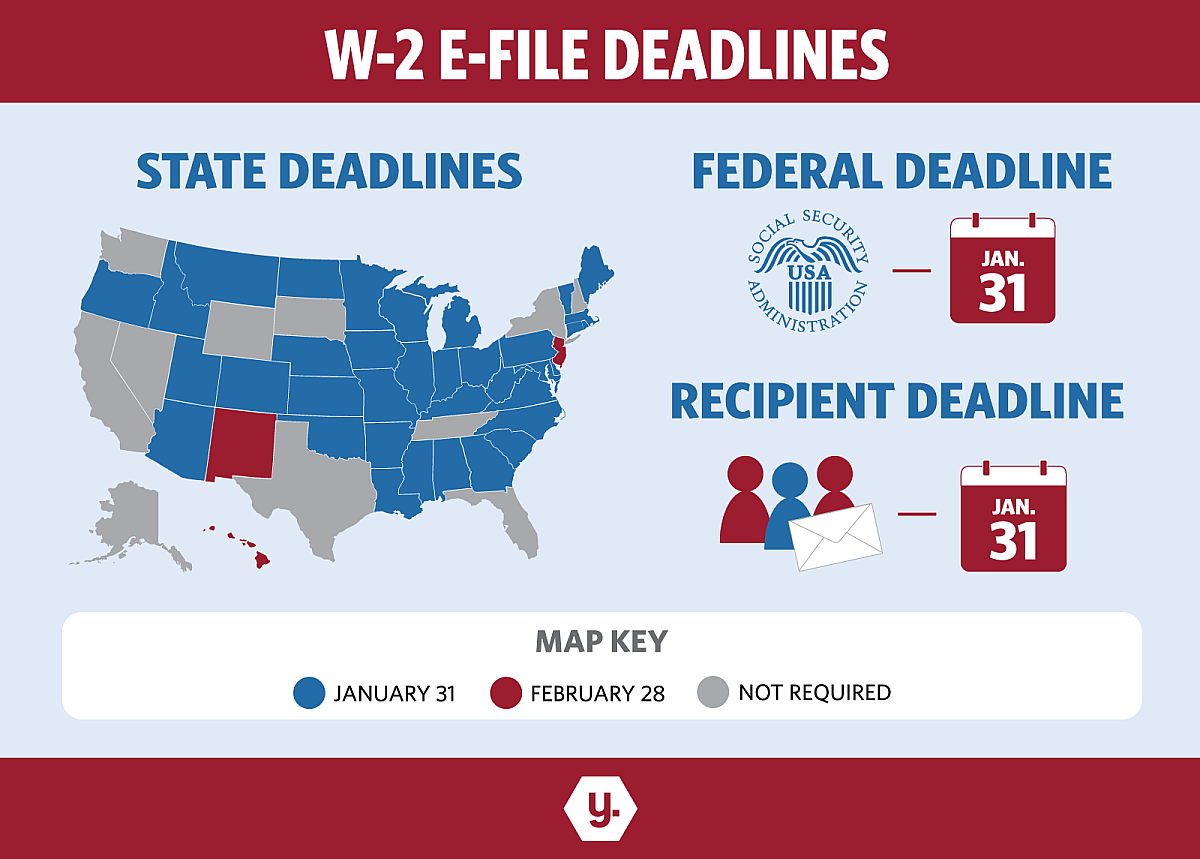

December 7, 2018W-2 E-File Deadlines

This infographic has everything you need to stay on top of the W-2 federal, state and recipient deadlines for tax year 2018.Read More -

November 29, 2018

November 29, 2018IRS Announces ACA Filing Extension for 2018

On November 29, 2018 the Internal Revenue Service (IRS) announced an ACA deadline extension for the 2018 filing season.Read More -

November 5, 2018

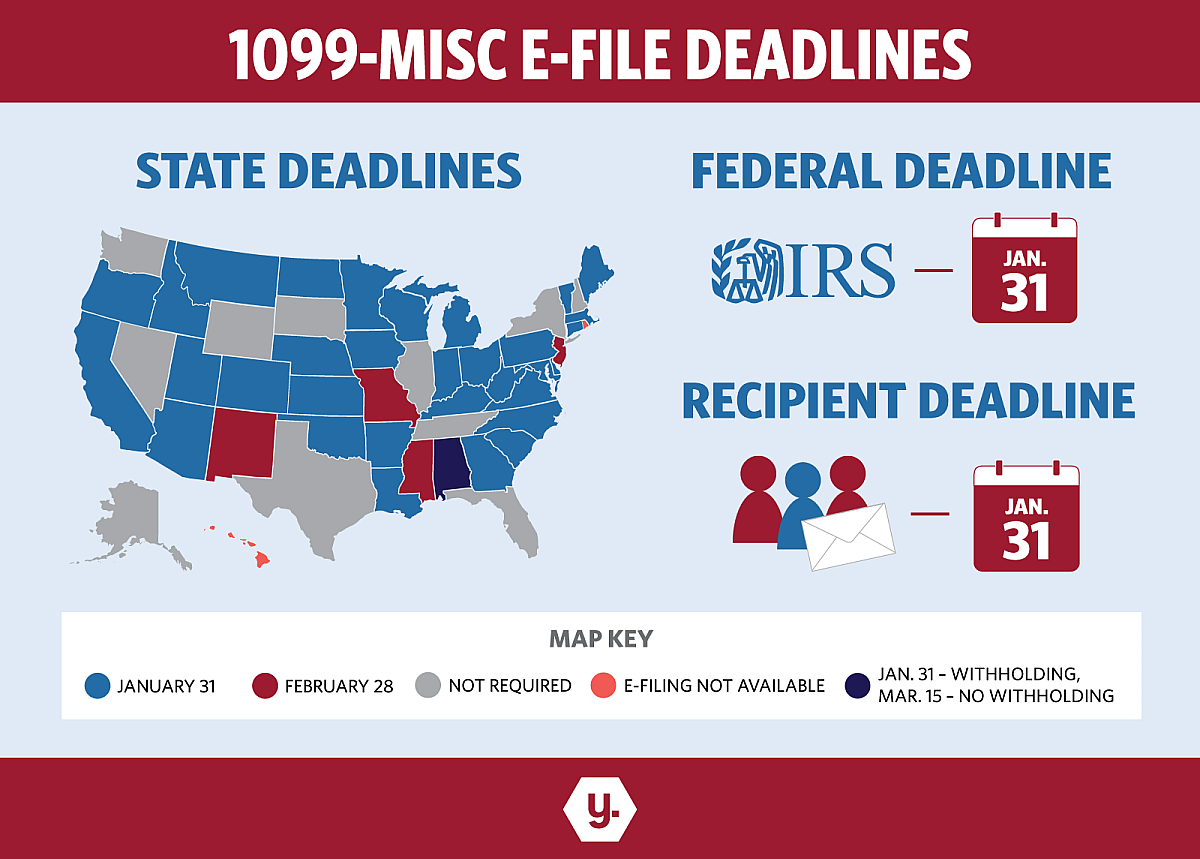

November 5, 20181099-MISC E-File Deadlines

This infographic has everything you need to stay on top of the 1099-MISC federal, state and recipient deadlines for tax year 2018.Read More