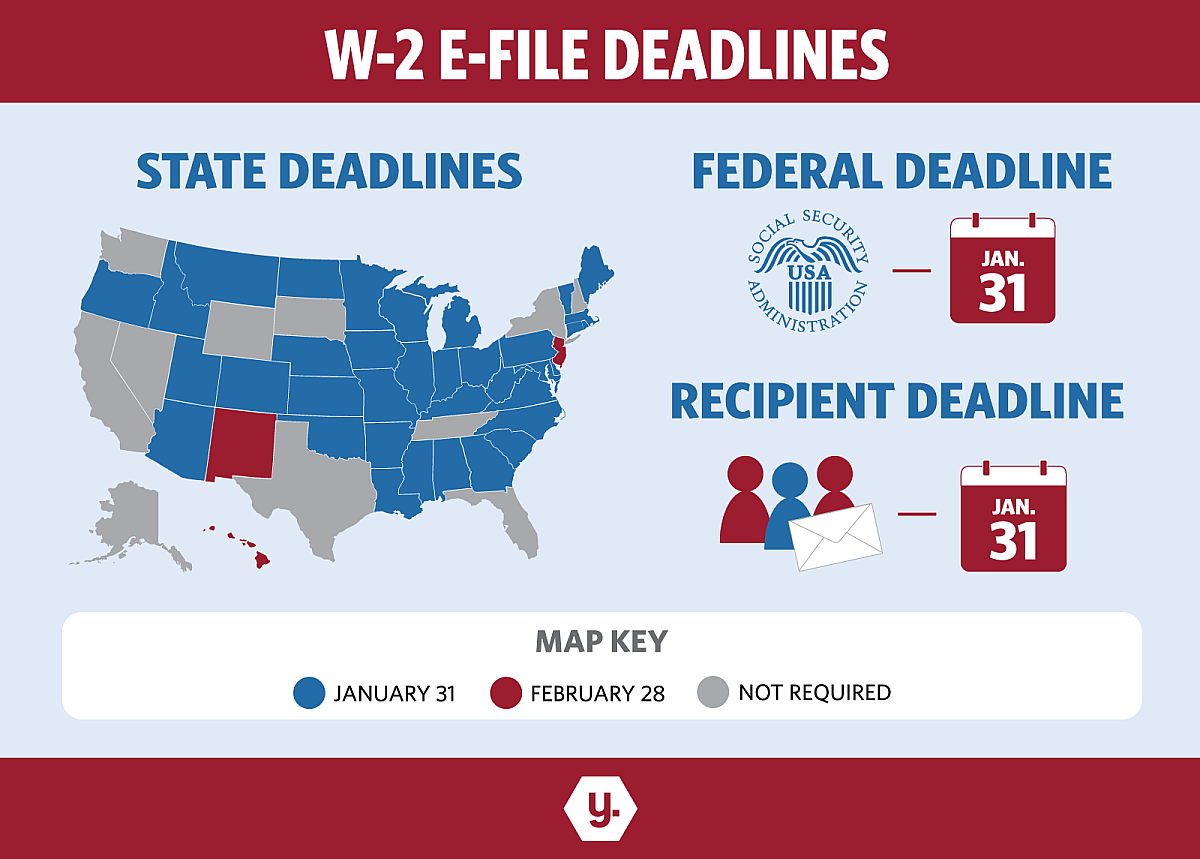

W-2 E-File Deadlines

This infographic has everything you need to stay on top of the W-2 federal, state and recipient deadlines for tax year 2018.

Greatland's Direct State E-file

Most states have W-2 and 1099 filing requirements that are separate from federal filing requirements. It is important to note these differences, because too often businesses mistakenly assume that filing to the federal government is enough to keep them in compliance. Unfortunately, that assumption is not true and can lead to penalties and fines. Therefore, it is very important to know your state-specific requirements when it comes to W-2 and 1099 reporting.

If you're unsure of state filing requirements for either the state where you do business, or the state where your employee or contract worker lives, Yearli will help identify your requirements.

Greatland is one of the few companies that offer state filing services for both W-2 and 1099 forms while requiring you to do zero research on what to do to file your W-2 or 1099 to states. We support a direct filing method which allows you to rest assured that your data is received by the state agencies in a timely fashion, and meets all state filing deadlines and reconciliation requirements.

Through Yearli, all of your data is sent to the appropriate state agency in the required format with just a few clicks.

Latest News

-

November 25, 2025

November 25, 2025New Alternative Furnishing Method for Forms 1095-B and 1095-C Comes with Complexities

The IRS has updated the Affordable Care Act (ACA) reporting process for Forms 1095-B and 1095-C. These changes aim to reduce administrative costs and simplify reporting, but they also create new compliance challenges for employers and health insurance providers.Read More -

October 8, 2025

October 8, 2025Your Business Guide to 1099 Filing in 2025: Deadlines and Compliance Tips with Yearli

Businesses must prepare for 2025 IRS 1099 filing by understanding key deadlines for Forms 1099-NEC and 1099-MISC and leveraging e-filing tools like Yearli to stay compliant. This guide outlines important dates, recent IRS updates, and practical tips to avoid penalties and streamline the filing process.Read More -

December 30, 2024

Understanding Form 1099-DA: A Comprehensive Guide to Filing for Digital Asset Transactions

As the use of digital assets like cryptocurrencies and non-fungible tokens (NFTs) continues to grow, so does the need for clear tax reporting guidelines. To address this, the IRS has introduced Form 1099-DA, which will be required starting in 2025.Read More