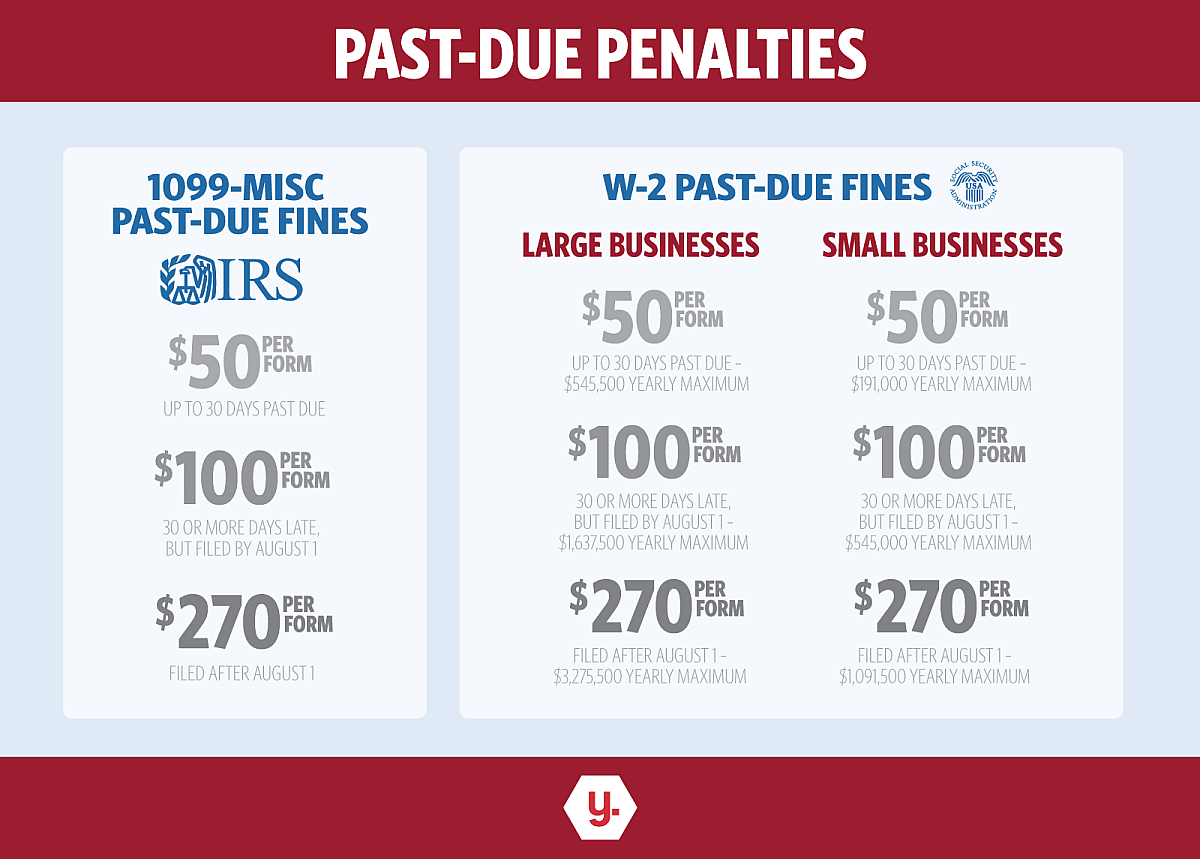

1099-MISC and W-2 Past Due Fines

Don't risk a fine this year for failing to file W-2 & 1099-MISC forms for your business.

Deadlines and requirements vary by state. That's why we've developed an easy tool to determine your filing requirements. Our custom calculator will tell you the federal, state and recipient deadline for the current reporting year. VIEW FILING DEADLINES

Latest News

-

November 25, 2025

November 25, 2025New Alternative Furnishing Method for Forms 1095-B and 1095-C Comes with Complexities

The IRS has updated the Affordable Care Act (ACA) reporting process for Forms 1095-B and 1095-C. These changes aim to reduce administrative costs and simplify reporting, but they also create new compliance challenges for employers and health insurance providers.Read More -

October 8, 2025

October 8, 2025Your Business Guide to 1099 Filing in 2025: Deadlines and Compliance Tips with Yearli

Businesses must prepare for 2025 IRS 1099 filing by understanding key deadlines for Forms 1099-NEC and 1099-MISC and leveraging e-filing tools like Yearli to stay compliant. This guide outlines important dates, recent IRS updates, and practical tips to avoid penalties and streamline the filing process.Read More -

December 30, 2024

Understanding Form 1099-DA: A Comprehensive Guide to Filing for Digital Asset Transactions

As the use of digital assets like cryptocurrencies and non-fungible tokens (NFTs) continues to grow, so does the need for clear tax reporting guidelines. To address this, the IRS has introduced Form 1099-DA, which will be required starting in 2025.Read More