Choose the Yearli plan that best fits your budget and business needs.

How To File With NetSuite Data

Yearli makes it easy to use NetSuite to file your 1099-MISC forms. Simply create a Yearli account, import your data directly from NetSuite, review your data and checkout. It's that easy. Yearli files your forms to the IRS, applicable state agency and sends copies to your recipients.

2. Create Account

Create a secure account using our multi-factor authentication sign up process.

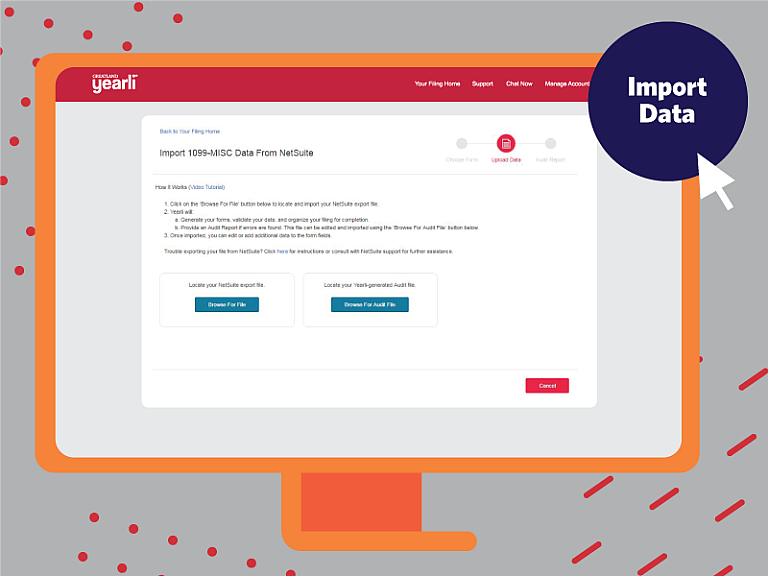

3. Begin Import

Review import instructions and import your NetSuite data using our custom template.

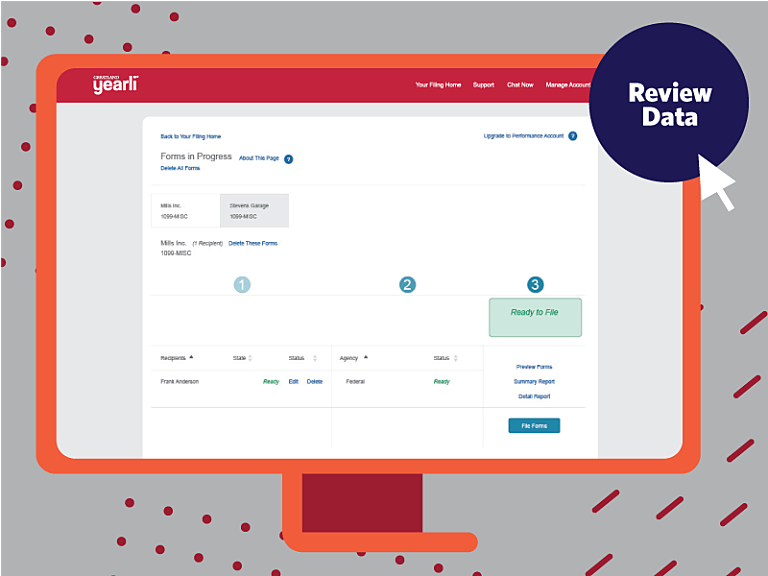

4. Prepare to File

Review the payer, recipient and form data. Also, choose to review and/or edit data by form.

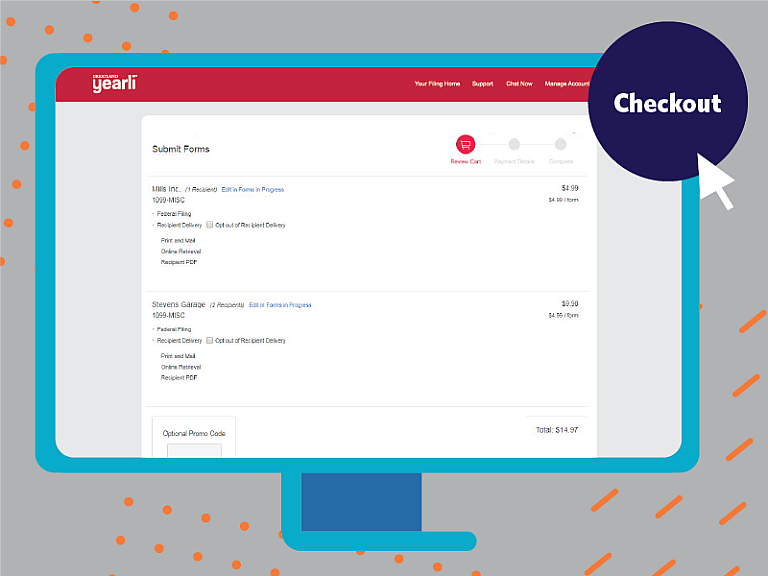

5. Check Out

Proceed to checkout and review filing information and cost.

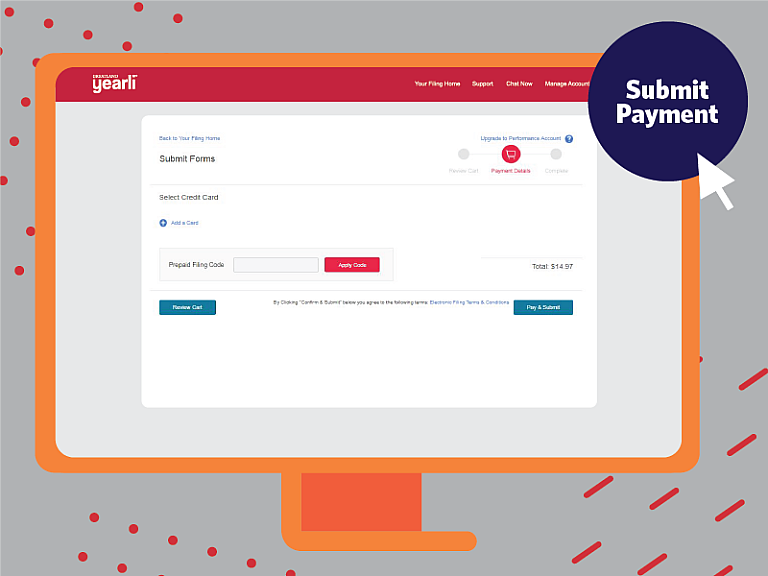

6. Submit

Enter payment information and submit forms to federal and state (where applicable) agencies and have forms sent to your recipients.

Ready to get started?

Simply choose your account type, register and begin filing forms for your business.