Yearli & Workday Data Integration - How It Works

Yearli makes it easy to use Workday to file your W-2 and 1095-C forms. Simply create a Yearli Premier account, register through Workday, import your data, review your data and checkout. It's that easy. Yearli files your forms to the SSA/IRS, applicable state agency and sends copies to your recipients.

Read More About Each Step Below

-

11. Create Account

-

22. Register Workday API

-

33. Connect Your Data

-

44. Choose Import

-

55. Review & Submit

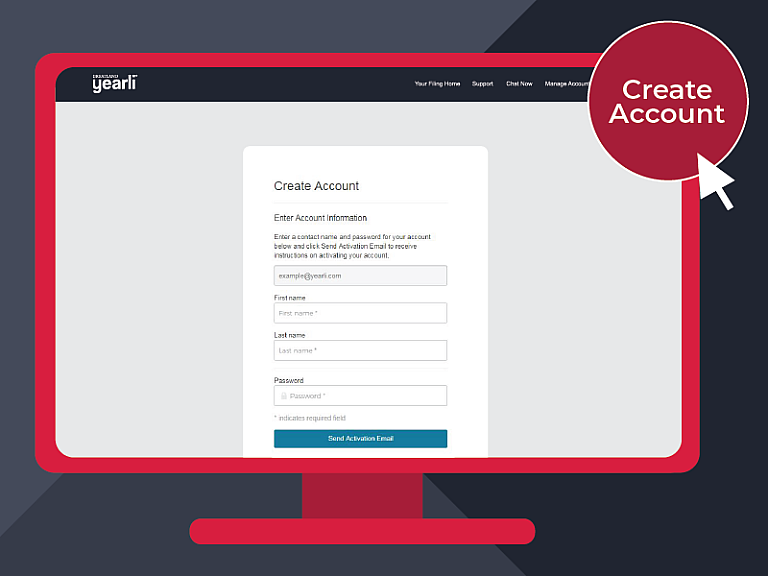

1. Create Yearli Account

Yearli Premier is the most complete W-2, 1099 and 1095 cloud-based online filing program on the market. Yearli Premier, when connected through Workday, delivers everything your business needs to file W-2 & 1095-C forms directly to the SSA/IRS, state agencies and send (via email and mail) copies to your recipients.

Best of all, Yearli Premier integrates directly with your Workday data!

2. Register API Client

After you have created your Yearli Premier account, you will need to register your API through Workday. This is a simple process and should only take a few minutes.

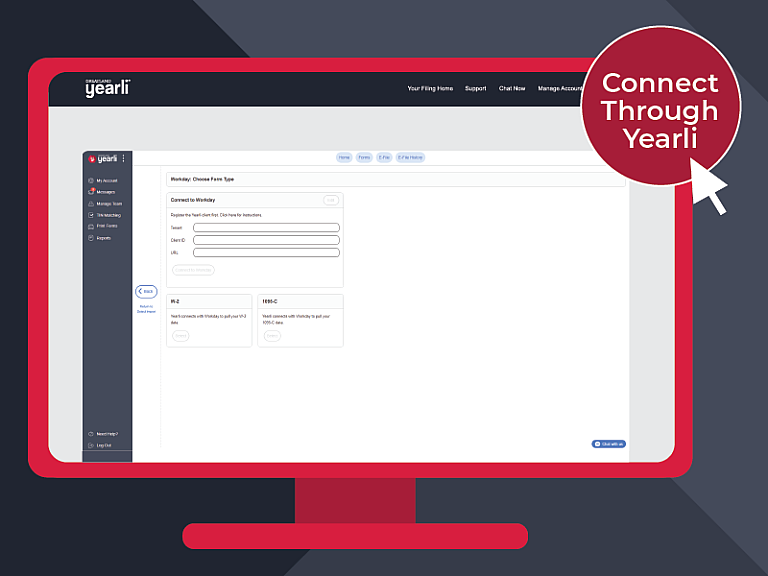

3. Connect Your Data

The next step, after you have created a Yearli Premier account and registered the approved Workday API, is to connect your data from Workday to Yearli.

This connection is quick and simple. Yearli and Workday have worked together to ensure your data is ready for a seamless integration process.

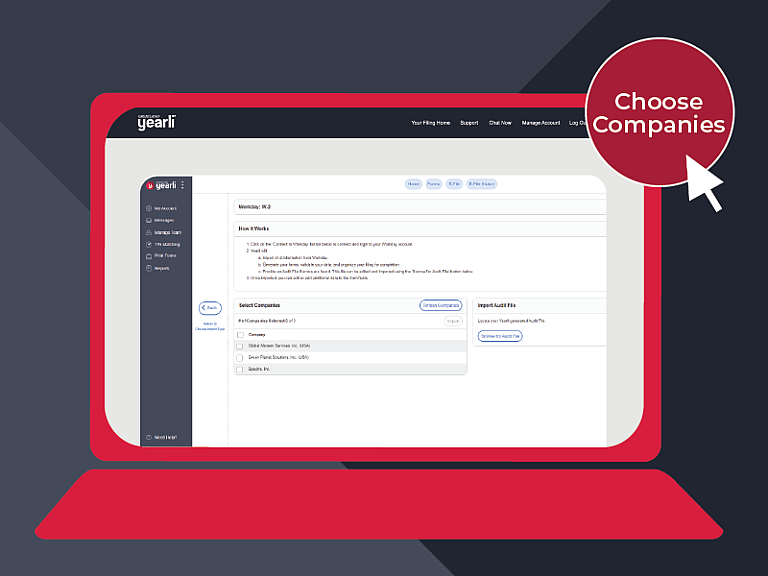

4. Import EINs

Once your data is connected from Workday to Yearli Premier, simply choose the EINs you want to import. Yearli will guide you through the next steps to file your W-2 & 1095 forms.

Yearli makes the entire process easy, whether you need to file for five companies or 500, you can easily make your selection and import in minutes.

5. Review & Submit Forms

After you submit your data through Yearli, forms can be delivered electronically to the SSA/IRS, state agency (where applicable) and sent directly to recipients.

Included with recipient print & mail fulfillment (if selected) is the Greatland online retrieval system. Here, forms are posted in a secure online portal for your recipients to download. Recipients will receive an email with a secure link to login and download their form.